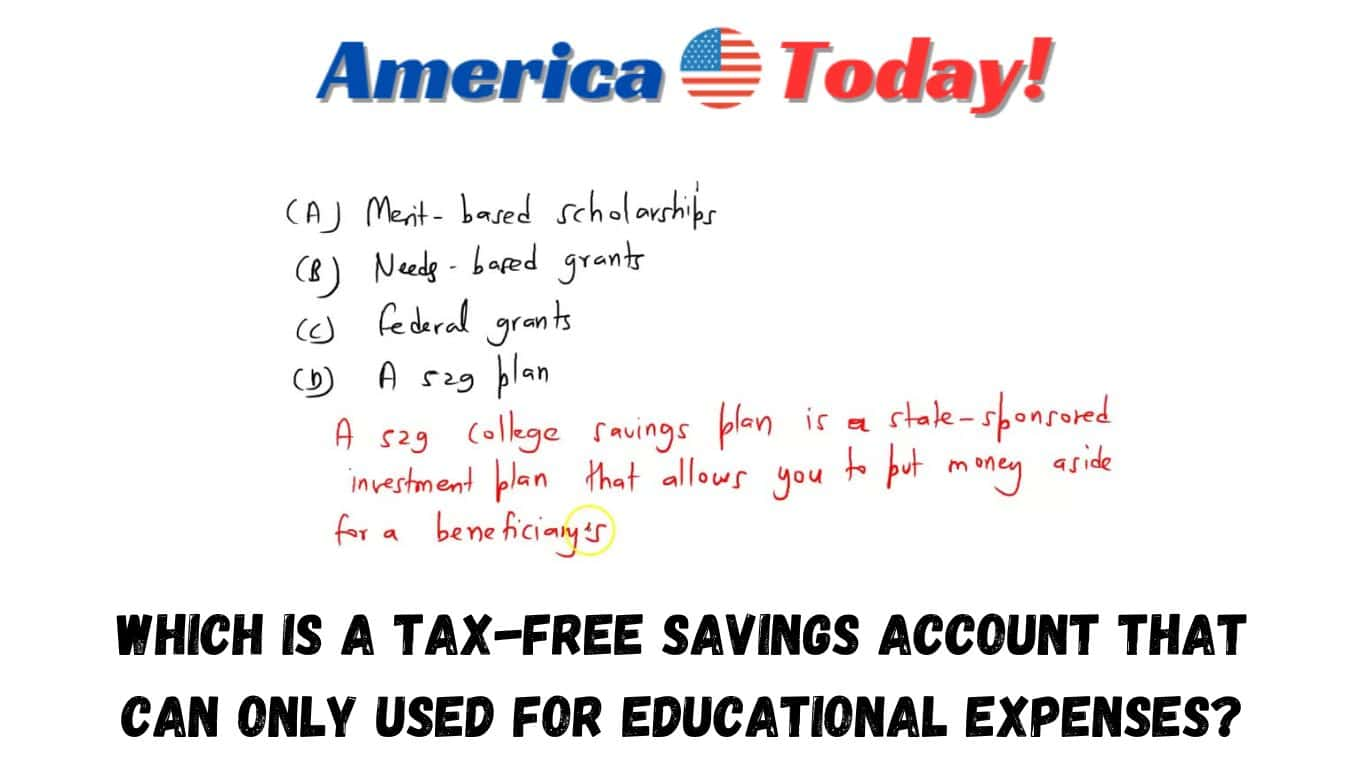

welcom to America today with a new article about which is a tax-free savings account that can only used for educational expenses?

The tax-free savings account that can only be used for educational expenses is known as a 529 plan.

This type of plan is designed to help families save money for education expenses such as tuition, fees, books, and room and board.

529 plans are offered by many states and can be used at any eligible institution nationwide.

Everfi is a financial education platform that offers courses on various financial topics, including 529 plans and other education savings options.

It seems like you’re asking about a tax-free savings account for educational expenses.

The 529 Plan is a tax-advantaged savings account designed specifically for education-related expenses.

These plans are sponsored by state governments and can offer significant tax benefits, allowing your investments to grow tax-free as long as the funds are used for qualified educational expenses.

There are two ways that savings accounts can reduce your tax bill.

Some accounts let you deposit pre-tax money, reducing your taxable income in the year you contribute.

Tax-Advantaged Retirement Accounts Whether you’re just starting your career or closing in on retirement, saving for retirement should be a high priority.

Using certain types of accounts will lower your taxes, leaving you with more retirement savings.

Individual Retirement Accounts There are several types of individual retirement accounts that help you save on taxes in different ways.

Nor are you taxed on any of the interest paid into the account before it is withdrawn.

While your money is in the account, it grows tax-free; you pay no taxes on the interest it earns.

56 In all these accounts, earnings on your investments go untaxed until you withdraw your funds.

8 Flexible Spending Accounts and Health Savings Accounts Flexible spending accounts and health savings accounts are programs that help provide some tax relief while helping with healthcare expenses and, in the case of certain FSAs, childcare expenses, too.910 Although the names sound similar, there are some key differences.

FSAs: Must be sponsored by an employer11 Must be set up with a deposit amount that usually must be declared at the start of the year and cannot be changed11 Do not roll over-if you don’t use the money, you lose it12 Are available for both healthcare and childcare expenses10 Don’t require that you have a high-deductible health insurance plan HSAs.

Do not require an employer sponsor Can be opened by anyone with a high-deductible health insurance plan Can be rolled over year to year-you don’t lose your money if you don’t spend it Can earn interest Can only be spent on qualifying health-related expenses Can serve as an extra source of retirement savings13 Health savings accounts can be opened for those who have a high-deductible health plan.

According to the Internal Revenue Service, for 2023, a high deductible health plan has a minimum annual deductible of $1,500 for self-only coverage or $3,000 for family coverage.

Under a high-deductible plan, annual out-of-pocket expenses for 2022 do not exceed $7,050 for self-only coverage or $14,100 for family coverage, rising to $7,500 for self-only coverage or $15,000 for family coverage in 2023.1514 Out-of-pocket expenses include deductibles and co-payments, but not monthly insurance premiums.

The annual contribution limit for a health savings account is $3,650 for 2022 for individuals and $7,300 for families.

If you have one-time or recurring medical expenses or an upcoming procedure that is not fully covered by insurance, and you have a good estimate of what your medical needs for the next year will be, it is worth considering one of these accounts.

Education Savings Accounts College or other education costs are another significant expense and reason that people save money.

Certain savings accounts can help by reducing the taxes you pay.

529 Accounts A 529 plan now lets you save for both K-12 education and post-secondary education costs.

18 Coverdell Education Savings Accounts Similar to a 529, a Coverdell education savings account is a trust or custodial account that can be used to pay for elementary, secondary, or post-secondary education expenses.

What Are Examples of Tax-advantaged Retirement Accounts That’ll Help Cut Your Tax Bill? Putting your money into individual retirement accounts and 401(k) plans will help you keep more money in your pocket.

What College Savings Accounts Might Help Consumers Pay Fewer Taxes in the Long Run? Savings in a 529 or Coverdell education savings account are withdrawn tax-free if they’re used for qualified education expenses.

19 The Bottom Line Savings accounts are usually taxed on the interest they earn.