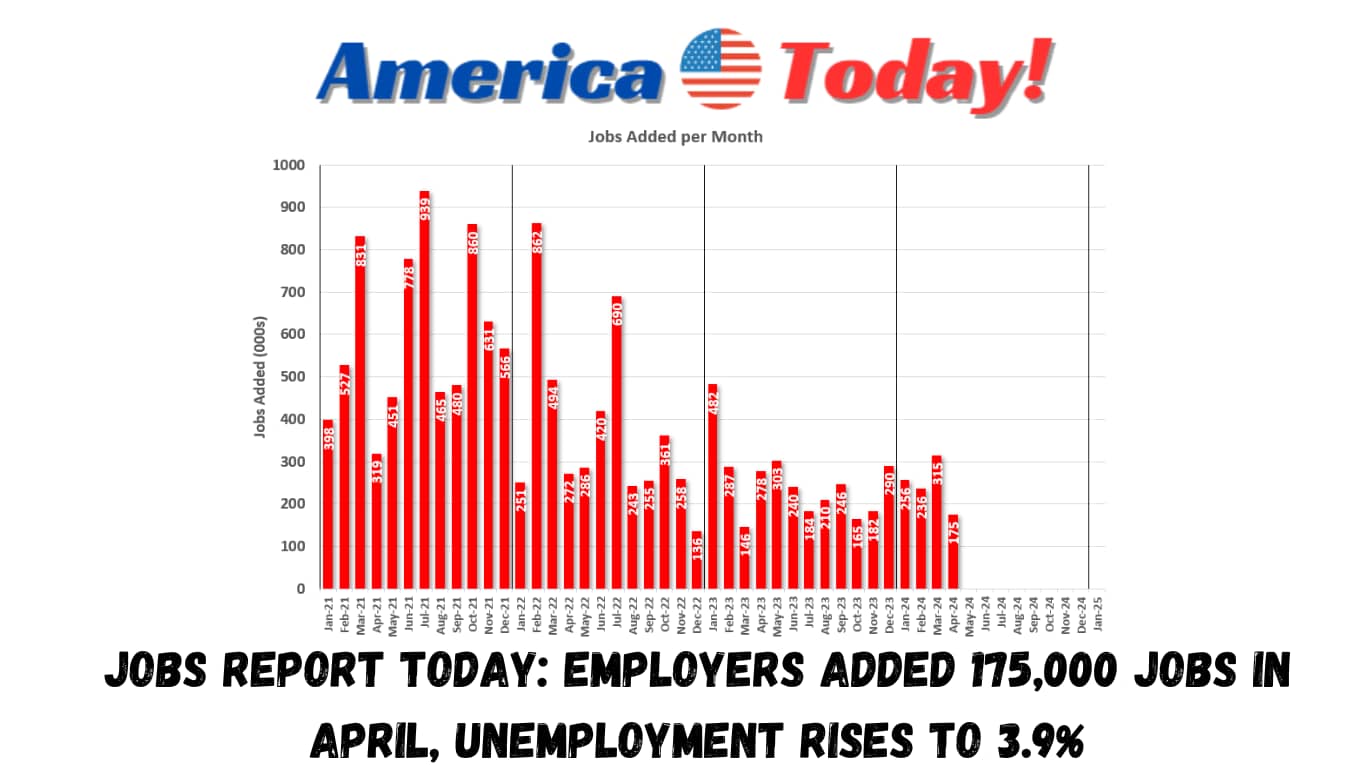

welcom to America today with a new article about Jobs report today: Employers added 175,000 jobs in April, unemployment rises to 3.9%

U.S. payroll growth slowed substantially in April as employers added 175,000 jobs amid high interest rates and stubborn inflation. The unemployment rate rose from 3.8% to 3.9%, the Labor Department said Friday.

Economists had estimated that 250,000 jobs were added last month, according to a Bloomberg survey. Sign that reads now hiring all shifts.

How is the US job market now?

Robust job growth has continued to stun economists. Employers have added well over 200,000 jobs a month this year as they’ve shrugged off persistent inflation and the Federal Reserve’s aggressive interest rate hikes intended to tame the price increases.

A big reason is a flood of immigrants who are both juicing household purchases and providing the labor supply needed to meet the increased demand. Immigration swelled the labor supply by about 80,000 a month last year and should provide a boost of about 50,000 a month in 2024, Goldman Sachs wrote in a research note.

Immigrants are helping fill an ample inventory of job openings, Goldman says, especially in industries like construction, restaurants and hotels. Job vacancies have steadily fallen from a record 12 million in mid-2022 to 8.5 million in March, Labor said this week. That’s the lowest since February 2021 but still well above the pre-pandemic level.

Other forecasters figured employment gains softened notably in April and will pull back further in the months ahead. Capital Economics says job growth was lifted by unseasonably warm weather in January and February but that likely faded in March.

Are layoffs increasing?

And behind the glitzy job numbers, the labor market is cooling. Hires, and the number of people quitting jobs (mostly to take new positions), fell further in March and both are below pre-pandemic levels. That underscores that net job growth continues to be bolstered by historically low layoffs rather than the need for new staffers. Companies have been reluctant to let employees go following COVID-induced labor shortages.

Yet while that propped up payrolls at the start of the year, when businesses normally cut holiday workers, a scarcity of layoffs is likely becoming a less prominent factor, Goldman says.

Small business hiring intentions have fallen to the lowest mark since the depths of the health crisis in May 2020, according to the National Federation of Independent Business.

By the second half of the year, some top economists expect average monthly job growth to dip below 100,000.

Jobs Report in the USA

On the contrary to the CES, the Bureau of Labor Statistics also handles the Current Population Survey (CPS), a monthly survey on 60,000 households providing a comprehensive examination of the US labor force. This survey also provides important information concerning the US labor force but is more statistically based, focusing on the unemployment rate and other employment and unemployment estimates.

With all of the data combined, there is a comprehensive and detailed account of the US labor market, and how it changes from month to month. This information is then used to generate the Employment Situation Summary, normally released on the first Friday of every month. This report is comprised of two major sections, one on the overall US labor market, the other with more detailed information such as industry status, for the most recent month. This information provides great insight into how the US labor market is affected by economic changes.

The Job Report is one of the most insightful indicators when trying to understand the current state of the US economy. This indicator provides detailed information on how the economy is affecting businesses and workers, the two key interest groups the Fed hopes to affect with its policies.

The report is generated by the Current Employment Statistics (CES) program, a monthly survey conducted by the Bureau of Labor Statistics. The survey is conducted with 39,000 businesses and 70,000 different types of work sites. Information used for the survey is taken from payrolls, and this together provides a representative sample of the US population. Based on this sample, the CES program is able to generate an accurate employment count, and at a later time employment numbers for specific subgroups.

This article provides tools for understanding the principal economic indicators in the United States. The primary economic indicators discussed in this article include: the jobs report, the Consumer Price Index, the Gross Domestic Product, and the Fed’s fund rate. Each indicator is used to provide insight into the current state of the US economy. These insights give the Federal Reserve the ability to make decisions regarding monetary policy.